SANTIAGO (Reuters) -Chile, the world's No. 1 copper producer, is in wait-and-see mode after U.S. President Donald Trump announced a surprise 50% tariff on imports of the red metal, with the Andean nation blindsided while its top miner held out hope of exemptions.

In a call with Reuters shortly after Trump's remarks, the chairman of Chilean state miner Codelco Maximo Pacheco said the firm wanted to know which copper products would be included and if the tariff would hit all countries.

"What we need to do is understand what this is about. What products are affected? Because he referred to copper in general terms. But copper includes a variety of products," Pacheco said on Tuesday in his first comments since the announcement.

"Then, we have to see whether this will apply to all countries or only some. We've always known that exceptions are made, and therefore, I think it's premature to comment."

U.S. Comex copper futures jumped more than 12% to a record high after Trump announced the planned tariffs.

Chile is the single biggest copper supplier to the U.S., a market that makes up less than 7% of its refined copper exports. Chile sends much of its copper to China, which dominates global copper refining.

Still, SONAMI President Jorge Riesco said tariffs could cause market uncertainty and price volatility that could hit Chile and other supplier countries.

He said the high prices driven by U.S. companies stockpiling copper ahead of possible tariffs were likely to be temporary, and warned that the U.S. would struggle to expand its own supply.

"The U.S. lacks the capacity for self-sufficiency and relies heavily on copper smelting and refining in China," Riesco said in a statement.

Chile's foreign ministry said the Andean nation had not received any formal official communication regarding the implementation of U.S. copper tariffs.

"We continue to be in contact and dialogue on this and other matters with the competent authorities and technical teams," the ministry said in a statement.

Chile, along with Canada and Peru, had previously pushed back against a probe by the Trump administration into imports of the metal and said they should not face tariffs.

Codelco's Pacheco said the U.S. would need growing amounts of copper, which goes into electric vehicles, military hardware, the power grid and many consumer goods.

"The United States is a country that needs a lot of copper, and it will continue to need even more copper," he said, adding it was getting harder to ramp up production. Codelco, the world's biggest copper producer, has seen output hit a 25-year low in recent years.

Pacheco estimated global demand would increase some 3% this year, which was creating a supply gap on top of flat output.

"The global copper supply is increasingly hard to raise. In fact, I believe that this year, it will be hard to produce more copper than last year," he said. "We also have to consider the reality of what's happening in the market."

(Reporting by Daina Beth Solomon and Fabian Cambero, Editing by Adam Jourdan, Veronica Brown, David Gregorio and Richard Chang)

Taipei [Taiwan], July 8 (ANI): Taiwan's Ministry of National Defense detected four Chinese naval vessels operating around its territorial waters as of 6 am (local time) on Tuesday.

Contrary to the usual, there were no Chinese aircraft.

In a post on X, the MND said, '4 PLAN vessels operating around Taiwan were detected as of 6 a.m. (UTC+8) today. Illustration of flight path is not provided due to no PLA aircraft operating around Taiwan were detected during this timeframe.'

https://x.com/MoNDefense/status/1942388168801804484

Earlier on Monday, Taiwan detected six Chinese Naval vessels around its territory.

In a post on X, the MND stated, '6 PLAN vessels operating around Taiwan were detected as of 6 a.m. (UTC+8) today. Illustration of flight path is not provided due to no PLA aircraft operating around Taiwan were detected during this timeframe.'

https://x.com/MoNDefense/status/1942025775739523514

Meanwhile, Taiwan's Mainland Affairs Council (MAC) has strongly urged China to engage in immediate talks over its unilateral launch of the W121 flight corridor, an extension of the contested M503 route, according to Focus Taiwan.

MAC officials say Beijing's latest move not only undermines prior cross-strait consensus and public opinion in Taiwan but significantly destabilises air safety in the Taiwan Strait and the surrounding Asia-Pacific region. Under International Civil Aviation Organisation (ICAO) regulations, any route adjustments must involve coordination with all affected airspace authorities, coordination that Taiwan says did not occur.

China's Taiwan Affairs Office spokesperson, Chen Binhua, defended the W121 route, claiming its objective was to 'benefit people on both sides of the strait' by reducing flight congestion, improving safety, and protecting travellers. However, the MAC countered that Beijing's international flight volumes have yet to recover to pre-COVID levels, and W121 does not serve any cross-strait destinations, Focus Taiwan reported.

Taiwan's Civil Aviation Administration echoed the MAC's concerns in a statement, calling China's unilateral move 'regrettable' and committing to close monitoring to secure flight safety. Officials warned that any aircraft encroaching on Taiwan's Flight Information Region would be intercepted or rerouted, in line with ICAO guidelines and recent national security protocols. (ANI)

Posted on July 9 2025

As the Office for Budget Responsibility noted yesterday in its new Fiscal Risks and Sustainability Report:

At 94 per cent of GDP, UK government debt is the fourth highest among advanced European economies… and with its 10-year bond yielding 4.5 per cent at the end of June, the UK government faces the third-highest borrowing costs of any advanced economy.

As they said:

The UK's public finances have emerged from a series of major global economic shocks in a relatively vulnerable position.

This appears to be a stark and troubling assessment for the Office for Budget Responsibility, but its implications go far beyond the standard economic arithmetic of debt ratios and gilt yields that dominate much of the OBR's analysis.

First, it is clear from the OBR's own data that the UK's weak fiscal resilience is happening despite taxes having risen to their highest level relative to GDP since the 1950s. In other words, we are taxing heavily but are still running deficits because underlying growth is weak, spending needs have risen, and will keep doing so.

This, though, is not a story of profligacy. It is the predictable consequence of running an economy on the basis of neoliberal dogma. There has been long-term underinvestment in productivity-enhancing public and private infrastructure, as well as austerity in local government and social services spending. This has gone on for so long that crises have become systemic, and hopes that deregulated markets and property bubbles can somehow deliver broad-based prosperity despite this have been shattered. The myth of financial engineering as a basis for prosperity has been blown apart.

Second, the OBR highlights the strain on pensions and health costs due to an ageing population. They note that state pension spending is set to rise from around 5% of GDP today to nearly 8% by the early 2070s, driven by longer life expectancy and the triple lock. Meanwhile, the shift from defined benefit to defined contribution pensions means that households shoulder more risk, many will lack adequate retirement incomes, and demand for gilts from pension funds will dwindle, which they suggest will push up government borrowing costs even further.

The result is that they suggest there is now a fiscal time bomb created decades ago by governments that decided upon the demise of secure workplace pensions, failed to build sufficient rental housing, and left too many self-employed individuals and low earners without meaningful pension savings. The consequence is higher future costs for housing benefit, social care, and, ironically, public debt service itself.

Third, climate change stands as the most daunting fiscal risk of all. The OBR calculates that if global temperatures rise to 3°C above pre-industrial levels, as now seems plausible, then climate-related damages could reduce UK GDP by 8% by the 2070s, pushing debt up by an additional 56% of GDP, just for this reason alone. The costs of transition to net zero add another 21% of GDP, even under moderate assumptions. And that transition might also make life possible, when at 3 degrees, the punishment is not just going to be to GDP, but life as we know it in many ways. Despite that, policymakers are still treating net zero as an economic burden to be minimised, rather than an essential investment in the country's future solvency and security. The costs of inaction vastly exceed those of transition.

So what does all this mean? It means we can't go on as we are. The first real risks to the UK's public finances, and to the living standards of future generations, come not from borrowing as the OBR would have it, but from our failure to invest productively, whilst creating hidden, off-balance sheet liabilities that dwarf any cyclical deficit.

This risk could be addressed. Instead of obsessing about debt levels, as the OBR does, we should be:

There is, however, more to it than that. We also need to rethink the financing of government:

In other words, the Office for Budget Responsibility needs to stop thinking that we live within a rigid and unalterable economic framework, when in fact we do not.

The OBR is right to issue a warning, but the real problem that the UK faces is not a deficit on the Treasury's cash accounts. It is, instead, decades of neoliberal neglect that have left us with fragile growth, insecure households, escalating climate risks, and a tax system that no longer does its job, plus ingrained thinking by the Office for Budget Responsibility amongst others that suggests structural reofmr of our finances is not possible when it is.

The answer is not to retreat further into austerity. It is to remake the economy so that our future spending needs, on pensions, healthcare, climate, and social support, are matched by an economy robust enough to fund them. That is the only sustainable path forward.

The benchmark price used for most fuel surcharges rose this week, resuming an upward trend that broader markets appear to believe have some more room to rise.

The weekly Department of Energy/Energy Information Administration average weekly retail diesel price rose 1.2 cents/gallon effective Monday, announced Tuesday, to $3.739/g. It’s the fourth increase in the last five weeks, with the price effective June 30, a week ago, posting a decline in that stretch.

While broad market forecasts continue to show an oil surplus in the second half of 2025, the OPEC+ group this past weekend acted as if the supply/demand balance was calling for more oil to be put on the market, and that’s what it did.

A subset of the OPEC+ group met virtually Saturday and agreed to add 548,000 barrels/day of oil back on to the market in August. That the group was going to increase its supply was a foregone conclusion.

But market analysts expected the OPEC+ group to add just another 411,000 b/d increase, which has been the size of the increases the group has been approving for several months.

The increases have been an unwinding of a series of cuts in output that the OPEC+ group–which consists of OPEC and a group of non-OPEC oil exporters nominally led by Russia–had in place since 2023.

The increases are the opposite of what might be expected given the forecasts of a supply/demand imbalance that favors buyers.

In the most recent monthly report of the International Energy Agency, the IEA said “in the absence of a major disruption, oil markets in 2025 look well supplied.”

The IEA spelled out a scenario in which global oil demand was expected to increase just 720,000 bd this year. The increase for July and August alone would cover that higher demand.

Despite the larger than expected increase in supply coming out of OPEC+, oil markets came out the weekend with a sharp increase. Ultra low sulfur diesel on the CME commodity exchange rose 5.13 cts/g to $2.4211/g, having climbed 11.39 cts/g since June 27. However, prices have not regained the highs that accompanied the early days of the fiercest fighting between Iran and Israel in mid-June.

Crude and diesel prices on CME were slightly higher in early trade Tuesday.

In a separate action, according to news agencies, Saudi Arabia announced an increase in its price formula for August sales that reflected a belief in a strong market.

Saudi crude pricing is calculated as a differential against key benchmarks, such as Brent for European sales and a basket of crudes in the U.S. The differential moves up and down in decisions announced by the Saudis a month in advance and are looked to by the broader market as a sign of how the Kingdom views strength in demand.

https://finance.yahoo.com/news/small-increase-benchmark-diesel-fourth-151710848.html

Canada is ready to ride the energy-security wave. U.S. attacks on Iran and sabotaged pipelines in the Baltic Sea have intensified fears about the fragility of sea routes and supply chains. Financial and logistical edges open a potentially lucrative strait from the Great White North.

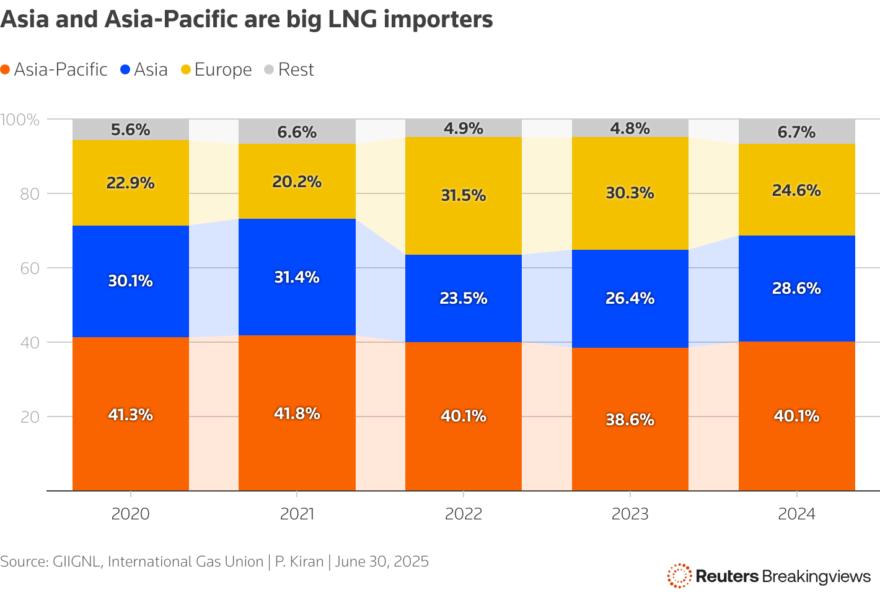

LNG Canada, a $32 billion joint venture among Shell, Malaysia’s Petronas and others, set sail into the murky liquified natural gas waters with its first shipment last week. Combined with other projects, the country is on track to represent nearly a fifth of LNG production capacity being constructed worldwide, according to the International Gas Union trade group. The Alberta government estimated it could become a top-five producer and exporter over the next decade.

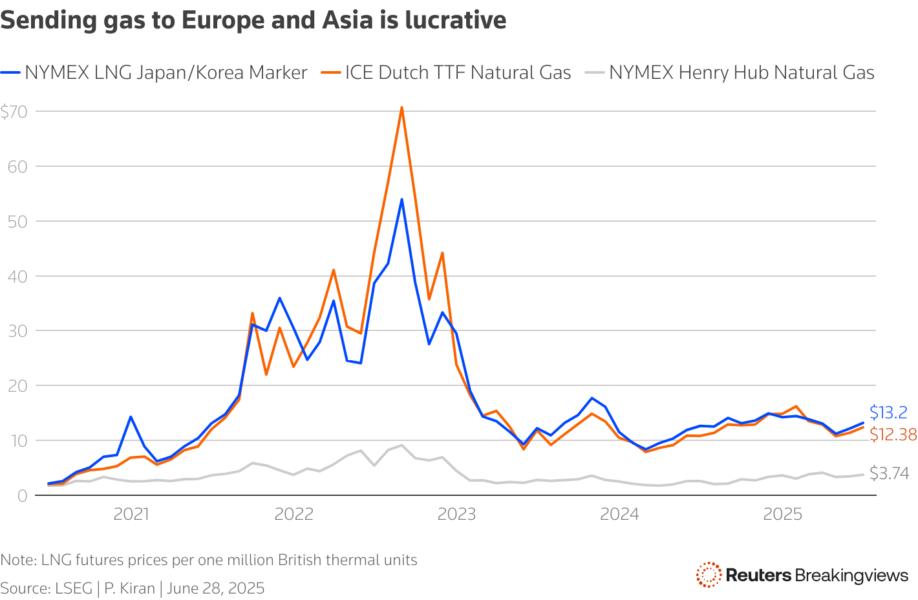

Canada has some natural advantages in a market whose demand Wood Mackenzie analysts expect to grow about 60% – slower than solar, but faster than oil – over the next 25 years. Shell said in May that it is targeting 4% to 5% LNG sales increases annually through 2030. Colder weather also helps lower the price of cooling the gas into liquid form for transport to Asian buyers, even though they are geographically closer to Australian producers.

Exporting LNG from Canada to places such as South Korea and Japan can cost between $8.10 and $9.56 per thousand cubic feet, a significant discount to the $8.90 and $10.80 range for U.S. projects in the Gulf of Mexico, Albertan officials reckon, using data from Rystad Energy. Canadian shipments also avoid frequent chokepoints like the Panama Canal. Qatar, a major Asian supplier responsible for a fifth of global LNG trade, depends on the narrow Strait of Hormuz.

These impediments facing rivals add up, especially because gas prices are typically far higher outside the United States. Although demand in Europe is shrinking, India and China thirst for ever-growing amounts of LNG to help power their faster-growing economies. About 180 million more people will have access to the gas grid in those two countries alone by 2030, Shell says.

LNG is only becoming more strategically and geopolitically significant. Russian President Vladimir Putin’s attempts to weaponize Nord Stream conduits to Europe tilted the industry axis toward North America. Transitioning to renewable energy sources depends on affordable gas as a bridge. Electricity-guzzling artificial intelligence also will keep companies and utilities actively hunting for all types of fuel. The world’s pain is Canada’s gain.

CONTEXT NEWS

Shell Canada Energy said on June 30 that the first shipment of liquefied natural gas had left the LNG Canada facility, a joint venture among Shell, Petronas, PetroChina and others.

When fully operational, the site will have capacity to export 14 million metric tonnes per year, Shell Canada said.

By Tsvetana Paraskova - Jul 08, 2025, 7:00 PM CDT

OPEC+ never fails to surprise speculators and market analysts. This weekend’s meeting to decide August production levels was expected to be a short routine video call to announce another output hike of 411,000 barrels per day (bpd).

Short it was, but the size of the increase for August was bigger than expected— 548,000 bpd. The eight OPEC+ members that are unwinding the cuts are expected to make another supersized increase in September, with which the 2.2 million bpd cuts will all be back on the market, at least the headline figures suggest so.

However, no one is really sure by how much OPEC+ is actually raising oil production these days because some producers are pumping less than quotas to compensate for previous overproduction. Analysts concur that the supersized hikes are not that supersized.

Summer Demand

OPEC+ continues to rely on strong summer oil demand to absorb the additional barrels. The physical market appears to be tight in the near term, although the coming glut in the autumn and beyond is likely to push oil prices further down.

Oil didn’t collapse following this weekend’s OPEC+ decision—a sign that there isn’t immediate fear of oversupply and that the market hasn’t shaken off entirely geopolitics-driven volatility.

Immediately after the OPEC+ meeting, Saudi Arabia raised the official selling price (OSP) for its crude destined for Asia and Europe in August, betting on robust summer demand to soak up the additional supply.

Current oil prices in the $60s per barrel are likely to encourage buying in Asia, as China continues to stockpile crude with high purchases at lower oil prices.

May and June arrivals are set to be strong as cargoes contracted a month or two earlier were at prices near four-year lows.

But much of the July, and especially August, supply was likely contracted in June, when oil spiked to four-month highs amid the Israel-Iran war. This suggests that Asian buyers, including top Asian crude importers China and India, likely bought lower volumes when prices were high.

Since the ceasefire announced by U.S. President Donald Trump at the end of June, prices have largely returned to pre-conflict levels, allowing again price-sensitive opportunistic buyers to seek more supply.

The current oil price, with Brent Crude in the high $60s per barrel, is the “right place” for crude prices, AS Sahney, chairman of state-owned Indian Oil Corporation, the biggest refiner in India, said earlier this week.

“There is still some room for it to go downwards. What I see is very much near to $65, plus or minus one or two dollars, is the right place where we will be comfortable,” Sahney told the NDTV Profit outlet on Monday.

If the strong Asian imports in May were largely due to low oil prices, then overall Asian demand later this summer may disappoint, as volumes contracted in June will be much lower due to the war premium in prices for most of last month.

Hence, demand may not be as strong as it appears to be, Reuters columnist Clyde Russell argues.

Weakness Beyond Summer

The market is still tight in the near term, with the tightness reflected in the strength in the prompt Brent timespread, ING commodities strategists Warren Patterson and Ewa Manthey wrote in a note on Tuesday.

“The expected supply surplus won’t materialise until later this year, when we expect more sustained downward price pressure,” they added.

The middle distillate market is also tightening, more so than the crude market. Gasoil refining margins are rising, while speculators hold the largest net long position – the difference between bullish and bearish bets – in gasoil for a year, according to ING.

In the United States, middle distillate inventories sit at their lowest level in more than two decades for this time of the year, the bank’s strategists noted.

Saudi Aramco’s crude price hikes to all regions for August-loading cargoes also signal that physical markets remain tight, “suggesting the additional barrels can be absorbed—for now,” Ole Hansen, Head of Commodity Strategy at Saxo Bank, wrote in a Monday note.

“In the short term, downside risks to crude appear contained,” Hansen said.

“Compensation cuts from previous overproduction are helping offset new supply, while geopolitical uncertainty in the Middle East continues to discourage aggressive short positioning by speculators.”

Recent consensus-beating economic data from the United States support a steady demand outlook, but continued trade tensions and tariff announcements somewhat dampen the bullish sentiment. In addition, “seasonal demand softening into autumn could emerge as headwinds in the months ahead,” Hansen noted.

Despite signs of current physical market tightness, analysts do not expect prices to top $70 per barrel for a sustained period of time, barring another major escalation in the Middle East.

Growing supply from the OPEC+ group, although not as high as the monthly headline figures suggest, is set to create an oversupply on the market going into autumn, even if summer demand holds strong. On the demand side, peak summer travel season may justify higher supply, but lingering trade and economic uncertainties may cap upside to prices.

https://oilprice.com/Energy/Crude-Oil/Can-the-Oil-Market-Absorb-OPEC-Output-Hikes.html

By Julianne Geiger - Jul 08, 2025, 12:25 PM CDT

Oil prices have inched up, but the EIA says don’t get used to it. The July Short-Term Energy Outlook (STEO) raised its 2025 Brent forecast by $3 to $69/bbl, citing a spike in geopolitical risk from the mid-June Iran nuclear conflict. But that bump is expected to be short-lived. With inventories building, the agency sees Brent falling to $58/bbl in 2026—a dollar lower than last month’s projection.

Meanwhile, U.S. crude output is peaking. Production averaged just over 13.4 million bpd in Q2, an all-time high, but is expected to decline slightly through 2026. The EIA expects average U.S. crude production to hold at 13.4 million bpd for both 2025 and 2026.

The U.S. is now free to export ethane to China, following a July 2 rollback of Commerce Department restrictions. That shift led the EIA to dramatically raise its ethane export forecast: 510,000 bpd in 2025 and 640,000 bpd in 2026, up 24% and 107%, respectively, from last month.

Natural gas storage is higher than previously expected. Inventories are forecast to hit 3,910 Bcf by the end of injection season in October, 5% higher than June’s estimate. That extra supply has pushed the EIA’s Henry Hub forecast down to $3.70/MMBtu for 2025 (down 7.5%) and $4.40/MMBtu for 2026 (down 10%).

Despite lower gas prices, the EIA expects U.S. wholesale power prices to climb 12% this summer compared to last, driven by higher year-on-year fuel costs and the risk of heat-driven demand spikes.

On trade, the STEO reflects S&P Global’s baseline: reduced tariffs on Chinese imports but an assumed return to 10% tariffs on other nations after the current 90-day pause expires in July.

Bottom line: Prices may look firm for now, but the fundamentals—especially oil and gas supply—point toward softness ahead.

Mines and processing plants in China produce the majority of the world’s rare earth metals and virtually all types of rare earth elements that are strategically important. This gives the Chinese government almost complete control over this sector in global trade, according to agronews.ua.

The New York Times reports that for decades in northern China, toxic waste from rare earth metal processing was dumped into an artificial lake covering four square miles. In south-central China, mines extracting rare earth metals have poisoned dozens of valleys and turned hills into barren red clay.

China’s leadership in the rare earth metals sector has come at a high cost, as for many years it has caused significant damage to the environment. The most damage has been done in Baotou and its surroundings, a flat industrial city with a population of two million located on the southern edge of the Gobi Desert.

The artificial lake with slag contains waste left after extracting metals from mined ore. In winter and spring, the slag dries up. The dust that rises is contaminated with lead, cadmium, and other heavy metals, including traces of radioactive thorium. During the rainy season, the slag is covered with a layer of water that mixes with toxins and thorium, seeping into the groundwater.

Government efforts to clean up have helped reduce some health and safety risks in this industry, but the situation has not improved significantly. Despite ongoing cleanup efforts, the Chinese authorities censor discussions about environmental pollution caused by the rare earth industry.

At the same time, the provincial government owns Baogang Group, a giant in the mining and chemical industry that operates the Bayan Obo mine, steel plants, and most of the rare earth metal processing plants in Baotou. Baogang is a cornerstone of China’s military-industrial complex.

https://agronews.ua/en/news/china-paid-a-high-price-for-leadership-in-rare-earth-metals-sector/

(Bloomberg) -- Gold dropped as investors parsed President Donald Trump’s decision to delay the start of increased duties on several trading partners, while insisting the new deadline is final.

The precious metal fell as much as 1.5%, with investors awaiting more details on the president’s approach to negotiations, after this week’s move to postpone the imposition of all the April 2 duties until Aug. 1, effectively buying each affected nation an extra three weeks to cut a deal.

“TARIFFS WILL START BEING PAID ON AUGUST 1, 2025. There has been no change to this date, and there will be no change,” Trump wrote on his Truth Social platform on Tuesday.

Treasury yields and a gauge of the greenback rose on Tuesday, putting pressure on non-interest bearing gold. A stronger dollar is also a headwind, making the precious metal more expensive for buyers in other currencies.

“Its really the FX and bond markets which are putting pressure on commodities, including precious metals,” said Nicky Shiels, head of metals strategy at MKS Pamp SA.

Gold has rallied significantly this year, setting a record in April, as Trump’s efforts to overhaul trade policies stoked uncertainty, boosting demand for havens. The advance has been supported by central-bank accumulation, with China announcing a fresh rise in official holdings earlier this week.

“Central banks are likely to continue to add gold to their reserves given the still-uncertain economic environment and the drive to diversify away from the US dollar,” ING Groep NV strategist Ewa Manthey said.

Spot gold fell 1.2% to $3,297.77 an ounce at 17:11 p.m. in London. The Bloomberg Dollar Spot Index rose 0.2%, after gaining 0.5% on Monday. Palladium, silver and platinum all declined.

©2025 Bloomberg L.P.

https://finance.yahoo.com/news/gold-steadies-investors-weigh-trump-073140158.html

Aris will maintain a first-ranking security interest over the project until the full payment of the purchase price is received. Credit: yuda chen/Shutterstock.

Aris Mining has entered a definitive asset purchase agreement to sell its Juby gold project in Ontario, Canada, to McFarlane Lake Mining for a total consideration of $22m.

The project comprises an exploration-stage gold venture and is situated in the Shining Tree area within Ontario’s prolific Abitibi greenstone belt.

The agreement includes Aris Mining’s complete interest in the Juby gold project and a 25% joint venture (JV) interest in the adjacent Knight property.

The sale is structured with Aris Mining receiving $10m in cash upon closing, along with common shares of McFarlane Lake Mining, which could represent up to 19.9% of its post-financing share capital.

To reach the full purchase price, an additional payment may be made within 12 months of closing, in either cash or more shares, at McFarlane’s discretion. However, Aris Mining’s aggregate shareholding in McFarlane will not exceed 19.9%.

Aris Mining CEO Neil Woodyer said: “The sale of Juby reflects our strategic focus on building a leading gold mining company in Latin America. Juby is a promising exploration property but is non-core to our operations in Colombia and Guyana.”

The completion of this deal is contingent on McFarlane securing at least $10m from a concurrent financing round and other standard closing conditions, including regulatory and third-party approvals. The transaction is expected to close within 90 days.

Aris Mining will maintain a first-ranking security interest over the Juby gold project until the full payment of the purchase price is received.

McFarlane CEO and chairman Mark Trevisiol said: “Our team is very excited to be working with Aris Mining on the acquisition of the Juby gold asset. The addition of this project to McFarlane’s portfolio will be accretive to our business and ultimately shareholder value.

“This acquisition transforms our junior gold exploration company into a gold exploration and development company. The team at Aris has been excellent to work with and we look forward to having them as a significant shareholder of McFarlane.”

In May 2024, Aris Mining entered a binding agreement with MDC Industry Holding to acquire an additional 31% JV interest in the Soto Norte gold-copper project in Colombia, which is touted as one of the largest undeveloped underground projects in South America.

https://www.mining-technology.com/news/aris-mining-sell-juby-gold-project-mcfarlane/

Chinese battery materials producer Dowstone Technology will build a $165 million copper smelter in the Democratic Republic of Congo (DRC), further expanding China’s already dominant presence in the country's refined copper sector.

The company announced the project on July 3, stating that the new facility will produce 30,000 tonnes of copper cathodes annually, pending regulatory approval from both Congolese and Chinese authorities.

The investment highlights China’s growing footprint in one of the world’s most critical copper-producing regions. In 2024, the DRC supplied 36% of China’s copper imports, a steep rise from just 10% in 2020. This surge reflects sustained Chinese investment in local copper mining and refining infrastructure.

Dowstone already operates in the DRC and expects its total local capacity to exceed 60,000 tonnes of copper cathodes per year by end-2024. Other Chinese players have also established major copper processing operations in the country. China Nonferrous Mining Corp (CNMC) runs the Lualaba smelter, opened in 2020, with an annual capacity of 100,000 tonnes.

In a parallel move, Zijin Mining and CITIC Metal signed long-term off-take agreements with Canada’s Ivanhoe Mines, securing 80% of output from the future Kamoa-Kakula smelter, slated to begin production in September 2025. With a capacity of 500,000 tonnes per year, it will be Africa’s largest copper smelter. Zijin holds a 39.6% stake in the Kamoa-Kakula mine.

These investments have paid off. In 2024, Congolese refined copper exports to China jumped 71% year-on-year, reaching 1.48 million tonnes.

China remains the world’s largest consumer and refiner of copper and other strategic minerals. The DRC, Africa’s leading copper producer and the second-largest globally, is a key part of Beijing’s supply chain strategy.

However, the Congolese government has expressed concern over its heavy reliance on Chinese investors. According to Marcellin Paluku, deputy director at the Ministry of Mines, 80% of DRC mining operations involve Chinese partners, which poses a “risk” to the economy.

To address this, Kinshasa is actively seeking to diversify its mining partnerships, targeting countries like the United States and Saudi Arabia. Whether this pivot will affect the pace or scale of future Chinese investments remains uncertain.

Aurel Sèdjro Houenou

• Guinea exported 99.8 million tons of bauxite in H1 2025, nearly reaching 2022’s full-year total

• Exports rose 36% year-on-year as the country strengthened its lead in global supply

• China remains the top buyer, taking in around 60% of Guinea’s bauxite exports

By the end of June 2025, Guinea had exported 99.8 million tons of bauxite, nearly matching its full-year total from 2022, which stood at 102.28 million tons. The comparison highlights how sharply Guinea has advanced in recent years to become the world’s top bauxite supplier.

According to official data reported by Reuters, Guinea’s bauxite exports rose by 36% year-on-year in the first half of 2025. Between 2022 and 2024, production increased by 37%, reaching 141 million tons. In 2024, Guinea exported 145 million tons, making it the global leader in bauxite exports. This surge is largely due to faster extraction by mining companies operating in the country, including the Alliance Guinéenne de Bauxite, d’Alumine et d’Aluminium (AGB2A/SDM), which shipped 19.70 million tons in 2024—up from 6.18 million tons in 2023.

Société Minière de Boké (SMB), the leading exporter in 2024, outpaced AGB2A/SDM, with a 13% rise in shipments. Compagnie des Bauxites de Guinée (CBG) also recorded strong export growth, rounding out the top three. Unlike producers such as Australia and China, which refine part or all of their bauxite locally, Guinea mostly exports the raw ore. China remains Guinea’s largest customer, receiving about 60% of its total bauxite exports.

The Guinean government, however, is working to develop a local alumina industry—the intermediate product between bauxite and aluminum. Conakry has toughened its stance in recent years, including halting operations by Emirates Global Aluminium after delays in building a promised refinery. Other projects are now moving ahead, such as the Chinese-backed State Power Investment Corporation, which began construction of its refinery in March 2025.

On June 25, the participants attending the annual meeting of the Low-Carbon Work Promotion Committee of the Steel Industry and the third Conference on Green and Low-Carbon Development of the Steel Industry in Rizhao, Shandong, reached a consensus that the global steel industry’s green and low-carbon transformation is a systemic change, which has now entered a critical period.

Three main pathways towards low-carbon steel production by 2030

In particular, the China Iron and Steel Association (CISA) suggested that the process of structure adjustment should be gradually implemented during the process of production reduction. For example, the low carbon development working team of CISA pointed out that three major metallurgical processes will face adjustment: the long steelmaking process of blast furnace-converter will gradually transit to the production of flat products, especially steel sheet, medium steel plate and other high-end steel plate, mainly located in the coastal deep water port area; the all-scrap consumption electric furnace will replace the small and medium blast furnace-converter to produce rebar and wire rod; the hydrogen reduction-electric furnace process is still in the exploration and development stage, while enterprises with conditions could carry out the related industrialization research and testing. It is expected that by 2030 the three processes mentioned above will account for 80-90 percent, 10-20 percent and three percent of the overall steel production in China.

Use of recycled raw materials should be encouraged through tax regulations

However, the management and application level of scrap is considered to be not commensurate with the position of scrap in the national economy. Thereby, CISA suggested China “take scrap as a strategic resource into the National Economic and Social Development Five-Year Plan Outline, while accelerating the pace of promoting the industrialization of scrap processing, regionalization, product development, and establishing a scrap recycling-categorization-processing-distribution system that is adapted to the steel industry layout in China.” The working team also recommended the clarification of the method of accounting for income tax of scrap recycling enterprises, the study of a preferential VAT policy for imported recycled steel raw materials, and the study of the improvement of the tax rebate ratio of steelmaking furnace materials to increase the incentive to use recycled raw materials.